By Manya Saini and Niket Nishant

(Reuters) – New York Community Bancorp’s shares rose on Thursday after a $1 billion infusion from a consortium of prominent investors led by former U.S. Treasury Secretary Steve Mnuchin’s firm helped soothe jitters around the lender’s finances.

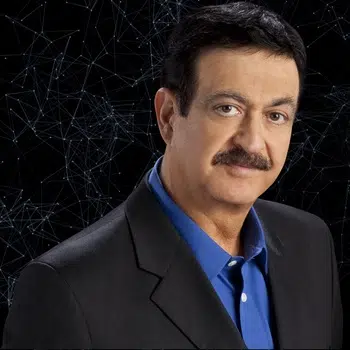

The bank also named ex-financial regulator Joseph Otting as its CEO, the latest in a series of measures undertaken to arrest a persistent stock rout that has pulled down NYCB nearly 67% since it reported a surprise loss in January.

Otting, the third to take the top job in less than a month, is a banking industry veteran who served as the 31st Comptroller of the Currency. He is credited with reviving IndyMac, a mortgage lender Mnuchin bought out of the Federal Deposit Insurance Corporation’s receivership in 2009 with an investor group.

NYCB will also add Hudson Bay’s Allen Puwalski and Reverence Capital’s Milton Berlinski to its board, alongside Otting and Mnuchin, as part of the deal.

“This capital infusion coupled with adding several big names in the banking space to the board of directors should give both depositors and investors comfort,” Piper Sandler analysts said.

NYCB shares were last up 5% before the bell on Thursday, following a volatile session in which the stock hit its lowest in 27 years before closing 7.5% higher on the news of the investment.

The bank’s troubles began late in January when it reported a surprise loss and slashed its dividend. Last week, it came under renewed pressure after flagging “material weakness” in internal controls and revising its loss to more than 10 times what was previously disclosed.

NYCB is set to host an investor conference later on Thursday morning.

‘MORE QUESTIONS THAN ANSWERS’

Wall Street analysts cheered the capital infusion and management shuffle, but said uncertainties remained.

“While the list of investors injecting capital into the company is certainly impressive, with more questions than answers remaining at this juncture, we wait on the sidelines for the upcoming conference call,” J.P.Morgan analyst Steven Alexopoulos said.

The capital infusion comes almost a year after the collapse of Silicon Valley Bank and Signature Bank ignited widespread concerns over the health of the U.S. regional banking sector and its heavy exposure to commercial real estate, which could lead to steep losses in loan portfolios.

“This transaction shores up the capital, and we expect the new board will be aggressive in marking the loan portfolio as it would be able to absorb much higher credit loss,” D.A. Davidson analyst Peter Winter said.

“However, there is still a lot of uncertainty on the level of deposit outflows and potential for turnover with private bankers.”

(Reporting by Manya Saini and Niket Nishant in Bengaluru; Editing by Devika Syamnath)

Comments